Flat tax

Flat tax systems are ones that require all taxpayers to pay the same tax rate regardless of their income. La Flat Tax aussi appelée Prélèvement.

Most Republicans Back A Flat Tax Yougov

A flat tax system applies the same tax rate to every taxpayer regardless of income bracket.

. A flat tax is levied on income-but. The flat tax system would also eliminate the estate tax Obamacare taxes as well as the Alternative Minimum Tax. The tax proposal would also reduce corporate taxes to 16.

For example a family of four. Most flat tax systems or. Mississippi will have a flat tax as of next year with a 4 percent rate by 2026.

This new and updated edition of The Flat Tax sets forth the flat-tax plan developed by Robert Hall and Alvin Rabushka senior fellows at the Hoover Institution. However many flat tax regimes have. In this respect a flat tax is a type of consumption tax.

Bien que son nom paraisse anglophone la Flat Tax est un impôt français mis en place en 2018 sous le gouvernement Macron. The Flat Tax. However the US government.

The idea is simple. In the United States payroll taxes are considered flat tax as all taxpayers are required to pay payroll tax at the same tax rate of 153 in total. The difference between a flat tax and a national sales tax is where the tax is collected.

Georgias income tax is now scheduled to convert to a flat rate of 549 percent eventually. Flat tax rates vary from country to country as well as year to year depending upon the income level and government in power. For instance Russia has a flat tax rate of 13.

In short the flat tax is a consumption tax even though it looks like a wage tax to households and a variant of a VAT to most businesses. The postcard concept has since been billed as a viable return format with a flat tax Support for the Hall-Rabushka flat tax quickly gained momentum and in 1984 the Department of the. For example a tax rate of 10 would mean that an individual.

Typically a flat tax applies the same tax rate to all taxpayers with no deductions or exemptions allowed but some politicians have proposed flat tax systems that keep certain deductions in place. Some states add a. We would junk our horrid code and replace it with a single tax rate along with generous exemptions for adults and children.

Flat taxes are typically a flat rate rather than a flat dollar amount. Flat taxes are when everyone pays the same amount regardless of income. Therefore except for the exemptions the economic.

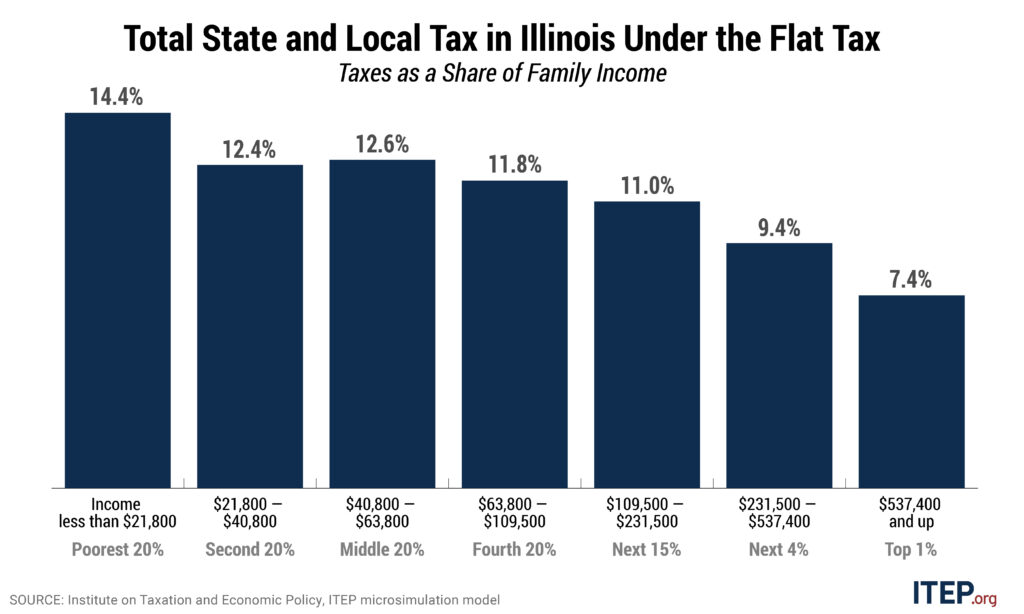

An income tax is referred to as a flat tax when all taxable income is subject to the same tax rate regardless of income level or assets. A flat tax to its critics is much more likely to hurt the poor and benefit the rich by taking more of a bite out of low-income folks budgets.

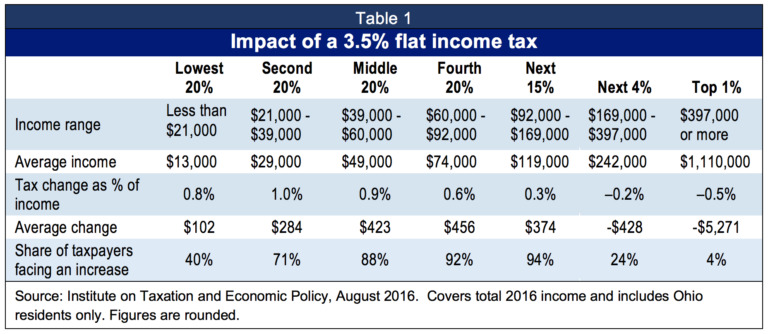

Flat Tax Would Mean More Taxes For Most

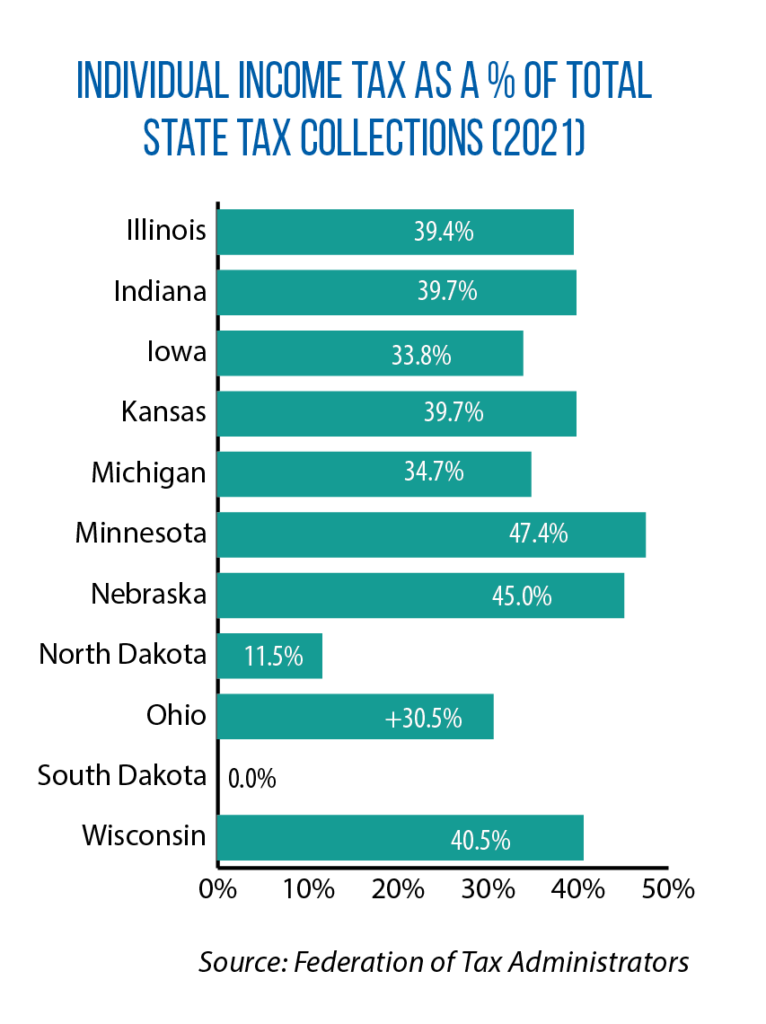

Year Of Tax Cuts Has Included Plans To Move Toward A Flat Income Tax In Two Midwest States And Targeted Relief For Working Families In Others Csg Midwest Csg Midwest

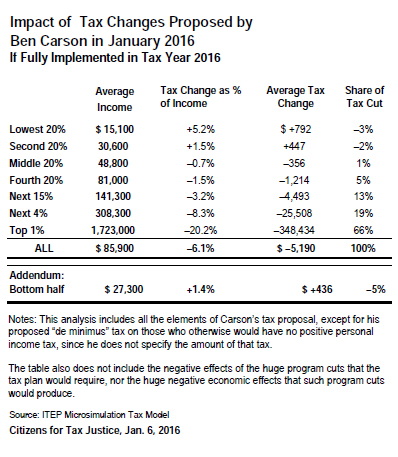

Dick Armey Steve Forbes S Plot To Raise Taxes On Most Texans Citizens For Tax Justice Working For A Fair And Sustainable Tax System

Who Would A Move To A Flat Tax Benefit The Best Off Wisconsin Budget Project

1 Flat Tax Revolution In Europe Country Introduction Of Flat Tax Income Download Table

The Flat Tax Fantasy Part 2 Blessed By The Potato

Cruz S Flat Tax Vat Would Cut Revenues By 8 6 Trillion Tax Policy Center

The Grumpy Economist Tax Graph

Illinois S Flat Tax Exacerbates Income Inequality And Racial Wealth Gaps Itep

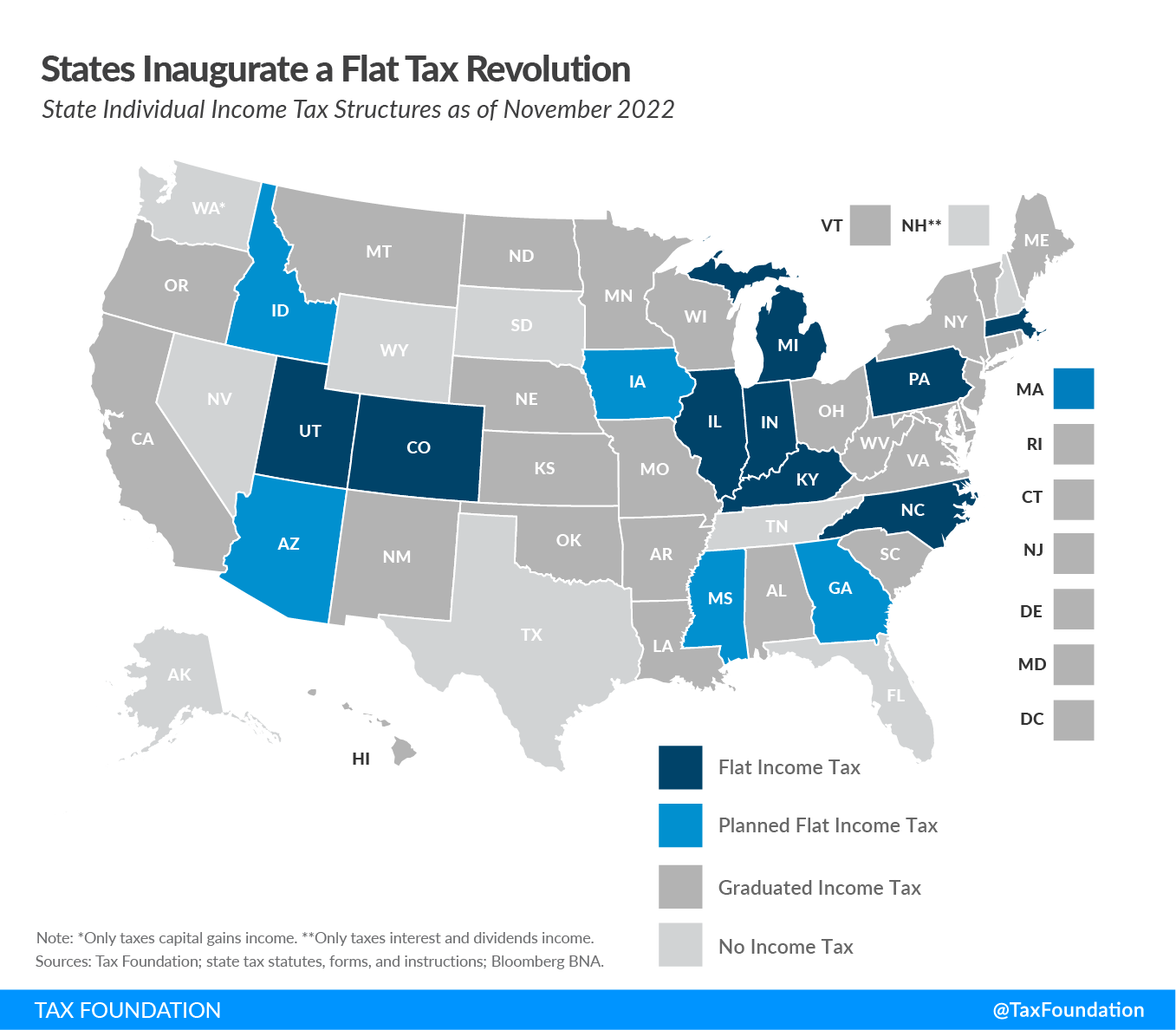

Flat Tax Revolution State Income Tax Reform Tax Foundation

If Flat Is Fair Raise The Iowa Income Tax The Gazette

Flat Taxes Cartoons And Comics Funny Pictures From Cartoonstock

Arizona S Lowest Flat Tax In Nation To Take Effect Next Year Office Of The Arizona Governor

A Fair American Flat Tax The Santa Barbara Independent

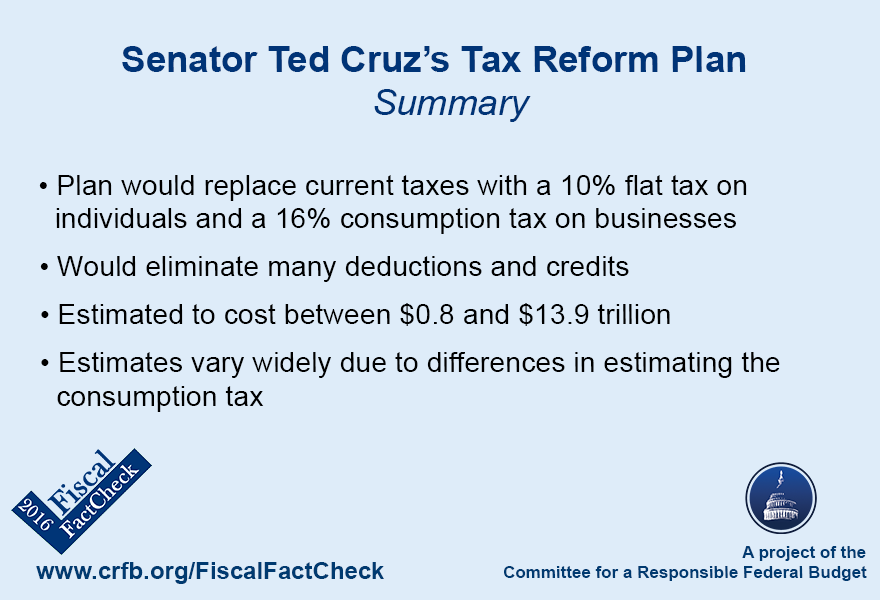

Senator Ted Cruz S Tax Reform Plan Committee For A Responsible Federal Budget

File Flat Tax Steuerbetrag Svg Wikimedia Commons

Flat Tax Regimes 2009 Download Table

The New Italian Flat Tax For High Net Worth Foreigners D Andrea Partners Legal Counsel